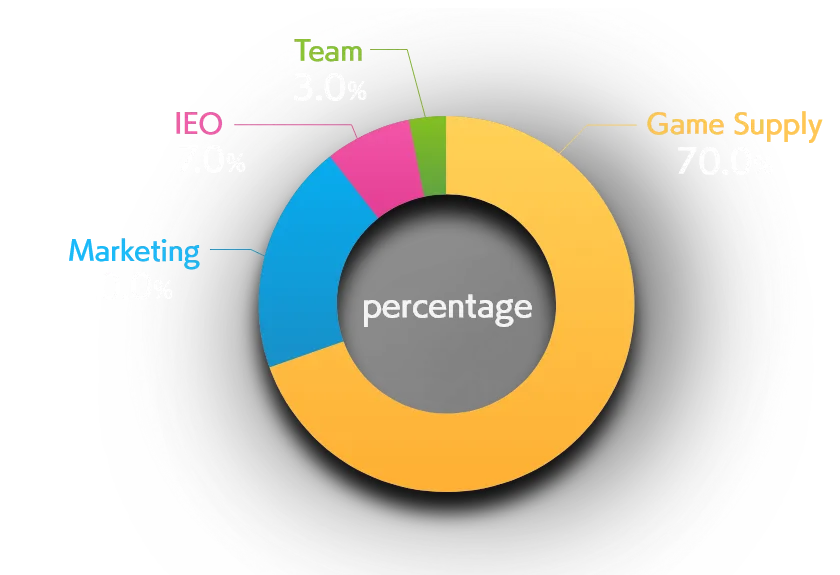

Token Holder Distribution

Initial Distribution

The total supply of BRIL is planned to be 1 billion, and is planned to be allocated as below. There will be no supply beyond 1 billion tokens.

| Types | Tokens | Supply % | Notes |

|---|---|---|---|

| Game Supply | 700,000,000 | 70.0% | Tokens issued when necessary. The amount issued is calculated based on the estimated amount to be rewarded to users based on the game’s performance. More details here. |

| Marketing | 200,000,000 | 20% | By September 2029, 7.55% of the total 20.0% will be unlocked. More details here. |

| IEO | 70,000,000 | 7.0% | |

| Team | 30,000,000 | 3.0% | By September 2029, 1.0% of the total 3.0% will be unlocked. More details here. |

| Total | 1,000,000,000 |

Game Supply

Used for rewards earned by users through gameplay.

At the time of the IEO, the full allocation will not be issued. Instead, the quantity to be issued will be calculated based on an estimated amount to be rewarded to users based on the game’s performance. These issuance will be approved by Brilliantcrypto and carried out as needed.

*The BRIL needed to be converted for BRIL points will also be part of this amount.

Marketing

Allocated to partner companies and individuals for the ongoing development and

maintenance of operations.

Additionally, allocations from Marketing may also be assigned to market makers and

similar entities for liquidity provision measures.

The entire allocated supply for Marketing is not issued at the time of IEO. A lock-up

period is set for a certain duration.

Please refer here for details about the lock-up period.

IEO

All quantities sold during the IEO will circulate in the market without any lock-up period.

Team

It will be used as an incentive for the team members developing and operating the project. To ensure a stable governance structure in the project's early stages and a long-term commitment, there will be a set period of lock-up for team allocations.

Please refer here for more details.

Regarding the sale of Brilliantcrypto’s BRIL tokens

The BRIL tokens that have been used in the game will be property of the issuer (Brilliantcrypto), and we plan to sell the corresponding holdings on the market. The total quantity for market sales is limited annually, as indicated in the following table:

| Fiscal Year | Sale Limit |

|---|---|

| September 2024 FY (IEO year) |

2% of total supply |

| September 2025 FY (2nd year) |

3% of total supply |

| September 2026 FY (3rd year) |

4% of total supply |

| September 2027 FY (4th year)onwards |

5% of total supply |

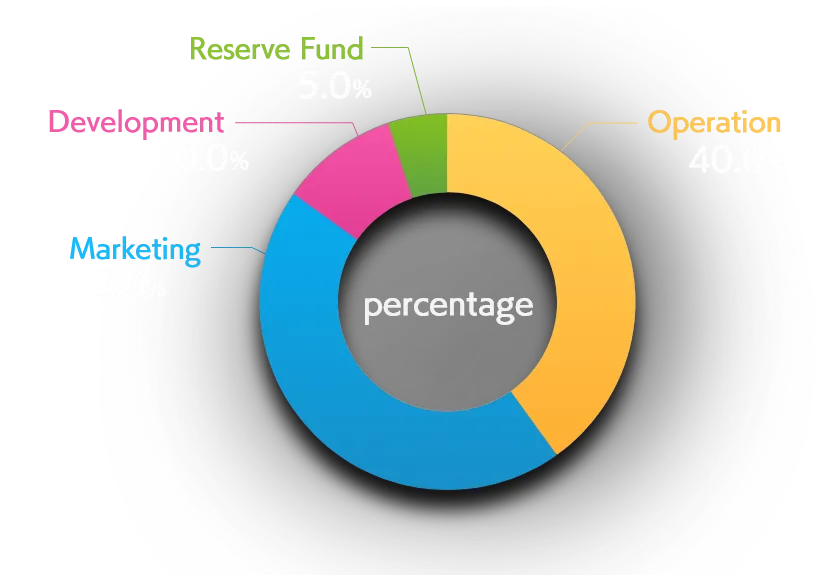

Use of Funds Raised

The breakdown of the use of funds raised is as follows:

40%:Operation

It will be used for activities related to issuer management, control, company operations, and payments to external experts such as cryptocurrency exchange operators necessary for the stable operation of BRIL.

45%:Marketing

It will be used for marketing activities to expand the user base and efforts to grow the community associated with this project.

10%:Development

It will be utilized for adding and maintaining features to expand the projct.

5%:Reserve Fund

The above funds usage, related expenses, and payment of taxes such as corporate taxes etc. will also be allocated.

Sales Restrictions of Team Allocation and

Lockup Period of Marketing Allocation

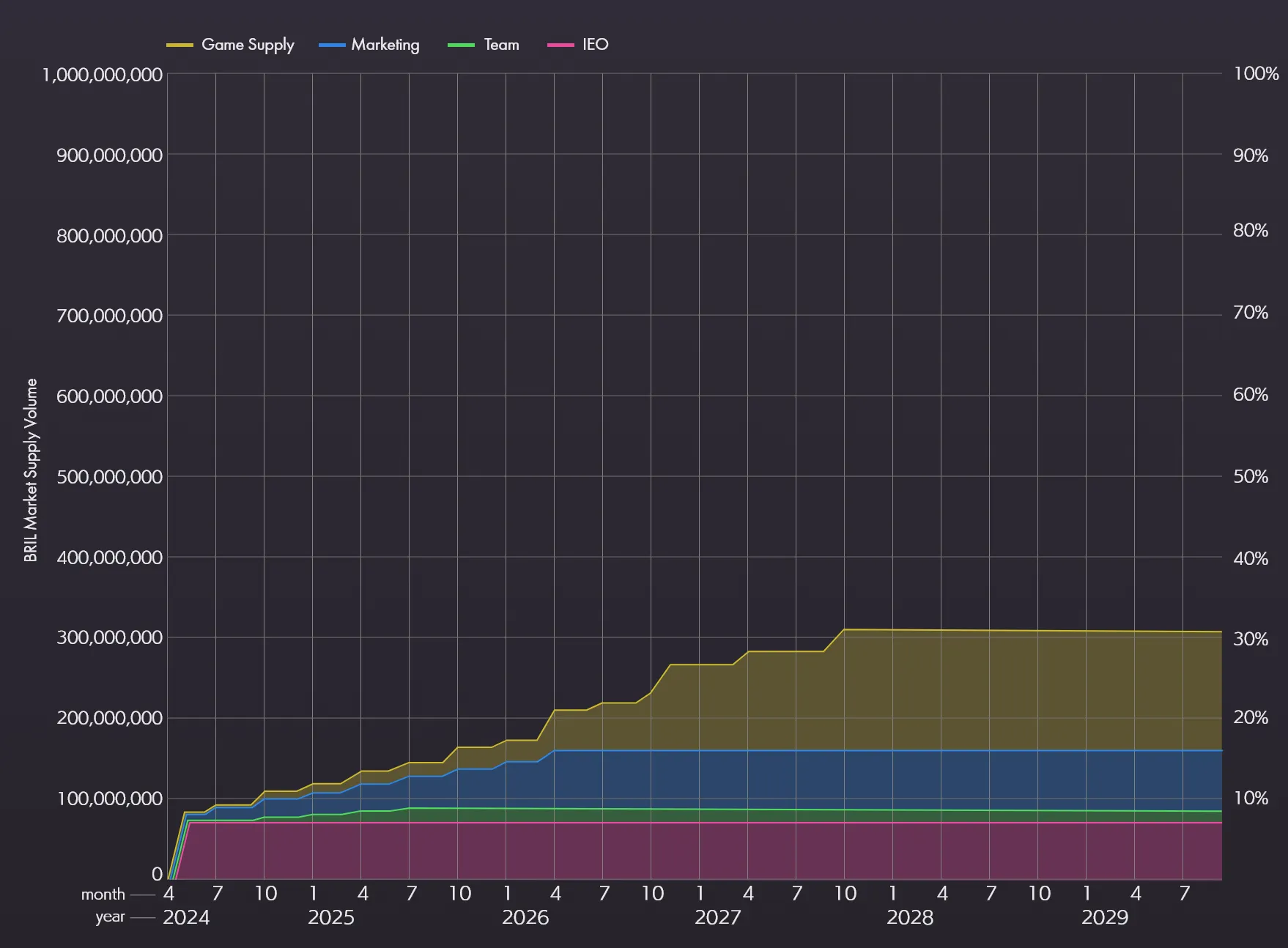

To ensure healthy growth of the market, maintenance of sustainable development, and operational structure, there will be sales restrictions applied to the Team allocation and lockup period is applied to the Marketing allocation. The unlocking of tokens, and release of sales restrictions will be conducted according to the table below in relation to the total distribution amount for that allocation.

Table 1 Restriction Period and Ratio of Team Allocation

|

Restriction Period (The date of IEO as 1Q) |

Ratio | |

|---|---|---|

| 1Q | 1st Year | 100% |

| 2Q | 1st Year | 100% |

| 3Q | 1st Year | 91.67% |

| 4Q | 1st Year | 83.33% |

| 5Q | 2nd Year | 75.00% |

| 6~23Q | 2~6th Year | 66.67% |

Table 2 Restriction Period and Ratio of Marketing Allocation

|

Restriction Period (The date of IEO as 1Q) |

Ratio | |

|---|---|---|

| 1Q | 1st Year | 96.23% |

| 2Q | 1st Year | 92.45% |

| 3Q | 1st Year | 88.68% |

| 4Q | 1st Year | 84.90% |

| 5Q | 2nd Year | 81.13% |

| 6Q | 2nd Year | 77.35% |

| 7Q | 2nd Year | 73.58% |

| 8Q | 2nd Year | 69.80% |

| 9Q | 3nd Year | 66.03% |

| 10~23Q | 3~6th Year | 62.25% |

*The final delivery date of BRIL in an IEO.

Unlocking of Allocation and

Market Circulation

| Fiscal Year | Market Circulation Supply at the End of Fiscal Year | Unissued | ||||

|---|---|---|---|---|---|---|

| IEO | Team | Marketing | Game Supply | Total | ||

| September 2024 FY (IEO year) |

70,000,000 (7.00%) |

0 (0.00%) |

15,100,000 (1.51%) |

461,739 (0.05%) |

85,561,739 (8.56%) |

914,438,261 (91.44%) |

| September 2025 FY (2nd year) |

70,000,000 (7.00%) |

10,000,000 (1.00%) |

45,300,000 (4.53%) |

15,138,720 (1.51%) |

140,438,720 (14.04%) |

859,561,280 (85.96%) |

| September 2026 FY (3rd year) |

70,000,000 (7.00%) |

10,000,000 (1.00%) |

75,500,000 (7.55%) |

53,420,188 (5.34%) |

208,920,188 (20.89%) |

791,079,812 (79.11%) |

| September 2027 FY (4th year) |

70,000,000 (7.00%) |

10,000,000 (1.00%) |

75,500,000 (7.55%) |

122,050,818 (12.21%) |

277,550,818 (27.76%) |

722,449,182 (72.24%) |

| September 2028 FY (5th year) |

70,000,000 (7.00%) |

10,000,000 (1.00%) |

75,500,000 (7.55%) |

149,357,981 (14.94%) |

304,857,981 (30.49%) |

695,142,019 (69.51%) |

| September 2029 FY (6th year) |

70,000,000 (7.00%) |

10,000,000 (1.00%) |

75,500,000 (7.55%) |

149,357,981 (14.94%) |

304,857,981 (30.49%) |

695,142,019 (69.51%) |

*These figures are purely estimates and do not guarantee the actual circulation in the market.

*The lockup period is complete after October of 2029. There is a possibility that 20,000,000 tokens (allocated to the team) and 124,500,000 tokens (allocated to marketing) will be liquidated. The issuer will determine the appropriate quantity at their discretion, taking into account factors such as trading volume and liquidity, to ensure that it does not significantly impact the market of BRIL.